Source Documents and Books of Original Entry 2

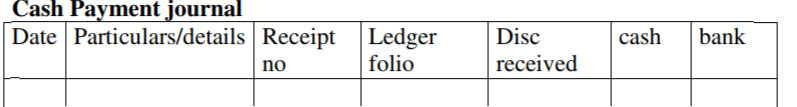

(v) Cash payment Journals

This is used to record cash and cheques that have been issued to the creditors/out of the business. Its totals are credited (Cr) in the cash and bank account and the individual accounts are debited (Dr) in their respective

accounts It uses the cash receipt received and bank slips issued as the source

documents. It takes the following format;

It takes the following format;

For example:

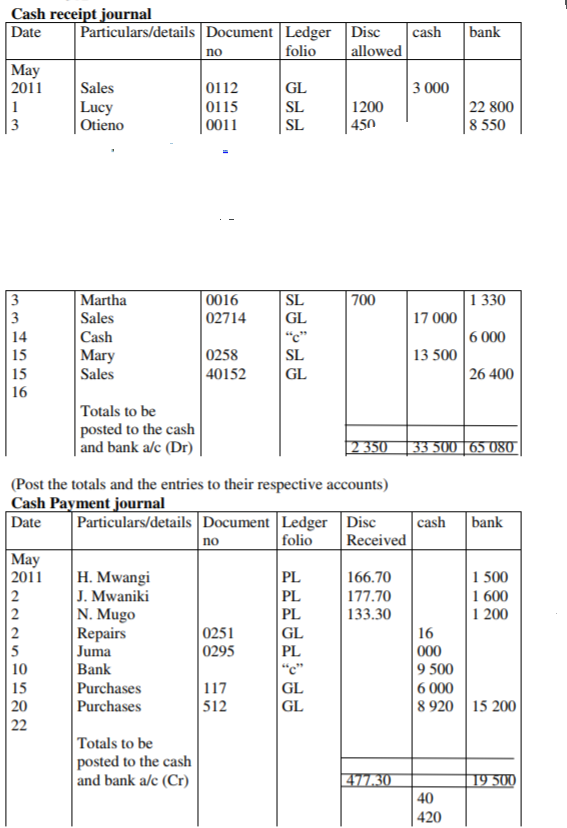

Record the following transactions into their relevant day books of Onyango traders, hence post the entries to their respective ledger accounts and balance them off;

May 2011:

“1. Cash sales amounting to ksh 3 000, receipt no 0112

“2. Paid the following creditors by cheque after having deducted a cash discount of 10% in each case; H. Mwangi ksh 1 500, J. Mwaniki ksh

1 600, N. Mugo ksh 1 200

“3. Receive the following Chaques from debtors in settlement of their debts after having deducted 5% cash discount in each case; Lucy kshs 22 800 cheque no 0115, Otieno kshs 8 550 cheque no 0011, Martha ksh 1 330 cheque no 0016

“5. Paid for repairs in cash kshs 16 000, receipt no 0251

“10. Paid Juma in cash kshs 9 500, receipt no 0295

“14. Cash sales kshs 17 000, receipt no 02714

“15. Banked kshs 6 000 from the cash till

“15. Received cash from Mary of kshs 13 500, receipt no 0258

“16. Cash sales of kshs 26 400 was directly banked, bank slip no 40152

“20. Cash purchases of kshs 8 920, receipt no 117

“22. Cash purchases of kshs 15 200 was paid for by a cheque, cheque no 512

(Post the totals and the entries to their respective accounts)

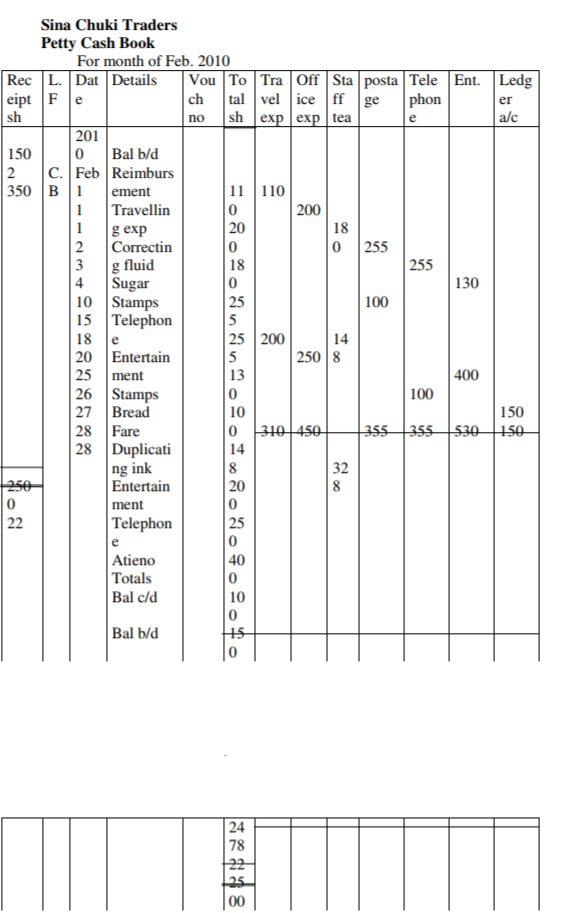

(vi) The petty Cash book

This is used to record money that has been set aside to make payments that does not require large amounts, such as cleaning, staff tea, posting letters, etc.

it is always kept by the petty cashier, under the supervision of the main cashier.

The amount received by the petty cashier is always debited, while the payments made from the same is credited.

The credit side also contains the analytical columns for various items of expenditure.

The amount credited is also extended to the analysis column for the specific item.

At the end of the stated period, the petty cash book is balanced, and the totals are posted to their individual accounts.

The individual’s accounts are debited with the totals of the analytical columns, while the cash account is credited by the main cashier

for the total that was spent in the petty cash book.

Petty cash book can also be operated on an imprest system, where the petty cashier receives a given amount of money at an intervals (imprest) to spend, and report back to the main cashier at the end of the period on how the money has been spent and the balance still remaining for re-stocking (reimbursed), and only the amount spent can be reimbursed so that at the beginning of the period the petty cashier will always have the full amount (cash float).

For example:

A petty cashier of sina chuki traders operate a petty cash book on an imprest of kshs 2 500 on a monthly basis.

On 1st February 2010, she had cash in hand

of shs 150 and was reimbursed the difference by the main cashier to restore her cash float.

The following payments were made during the month of February 2010

Feb; 1. Travelling expenses kshs110

2. Correcting fluid kshs 200

3. Sugar for staff tea ksh 180

4. Stamps kshs 255

10. Telephone kshs 255

15. Entertainment kshs 130

18. Postage stamps kshs 100

20. Bread for staff tea kshs 148

25. Fare kshs 200

26. Duplicating ink kshs 250

27. Entertainment kshs 400

28. Telephone kshs 100

28. Atieno a creditor was paid

Required;

Prepare a petty cash book from the above information and post the totals to

the relevant ledger accounts.

The totals in the analytical columns are Debited in the individual accounts, with the petty cash book totals being credited in the cash account.

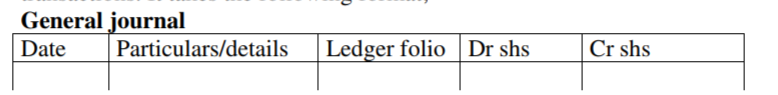

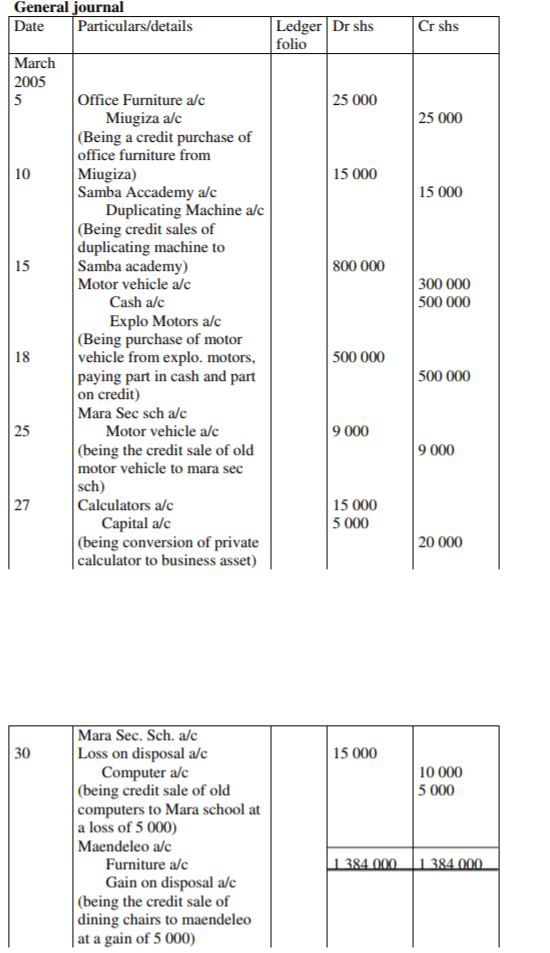

(vii) The general Journal/Journal proper

This one is used to record purchases or sales of fixed assets of the business on credit.

These assets do not form part of the stock since the business does not deal in them, however the business may decide to buy or sell them for one reason or the other.

In this journal, the account to be debited begins at the margin, while the account to be credited is indented from the margin, with a narration below them put in brackets.

The narration simply explains the nature of the

transaction that has taken place.

The individual entries are then posted to their respective accounts by either debiting or crediting depending on then transactions. It takes the following format;

For example:

Journalise then following transactions which took place in the business of J Opuche during the month of March 2005 March 5; Purchased office furniture on credit for shs 25 000 from miugiza

Furniture Limited

10; Sold old duplicating machine for shs 15 000 to samba academy on credit

15; Bought a new motor vehicle for shs 800 000 from explo motors Ltd, paying shs 300 000 in cash and balance was to be settled at a later

date

18; Sold old vehicle to Mara Secondary school for shs 500 000 on credit

25;The owner converted personal electronic calculator valued at shs 9 000 into business asset

27; Sold old computers valued at shs 20 000 for shs 15 000 on credit to Mara secondary school

30; Sold old dining chairs worth shs 10 000 to Maendeleo for shs 15 000 on credit accounts.

The entries are then transferred to their respective accounts in the ledger, with

the ones debited in the journals being debited and the ones credited being credited.

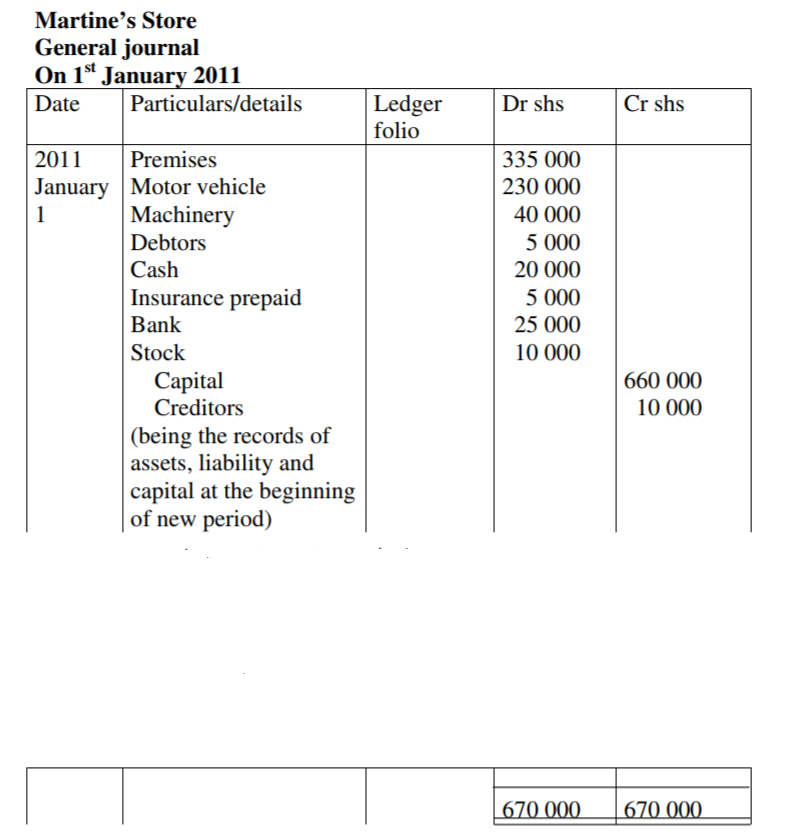

The Journal proper can also be used to show the opening entries and the closing entries. That is; Opening entries

The opening entries are the entries of the assets and liabilities at the beginning of the trading periods to facilitate the opening of different accounts for them.

They are the balance b/d for the assets and liabilities of the business.

The assets to be debited are recorded first, followed by the liabilities and capital to be credited.

In case the capital is not given, it can be calculated using the book keeping equation, that is A = C + L. the narration then follows the entries.

The opening entries are necessary when;

A business that did not keep complete accounting records would like to start keeping.

Opening up new sets of accounting books, after closing the old ones.

Starting accounting records for a business which has been bought,though was in full operation For example;

The following balances were extracted from Martine’s store that did not keep complete records, and would like to start keeping on 1st January 2011.

Prepare for them their relevant subsidiary book to show the balances.

Shs

Motor vehicles 230 000

Machinery 40 000

Creditors 10 000

Debtors 5 000

Cash in hand 20 000

Stock 10 000

Insurance prepaid 5 000

Bank 25 000

Premises 335 000

Capital 660 000

cash book/cash book Petty cash voucher Petty cash book

Uses of Journals

Source Documents and Books of Original Entry 1 | Source Documents and Books of Original Entry 2 |

Scholarship 2026/27

Current Scholarships 2026/2027 - Fully Funded

Full Undergraduate Scholarships 2026 - 2027

Fully Funded Masters Scholarships 2026 - 27

PhD Scholarships for International Students - Fully Funded!

Funding Opportunities for Journalists 2026/2027

Funding for Entrepreneurs 2026/2027

***