Source Documents and Books of Original Entry 1

These are documents containing the information that makes basis of making entries in the books of accounts.

They act as evidence that the transaction actually took place.

They includes Cash sale receipt: - a document that shows that cash as been received or paid out of the business either in form of cash or cheque.

It is a source document that is mainly used in making records in the cash journals cash

book, cash accounts or bank accounts.

If the receipt is received, it means

payments has been made and therefore will be credited in the above accounts, or taken to cash disbursement/payment journals, while when issued, it means cash/cheque has been received and therefore will be debited in the above

accounts or taken to cash receipt journals

Invoice:

A document issued when the transaction was done on credit to demand for their payment.

If the invoice is an incoming invoice/invoice

received, then it implies that the purchases were made on credit, and if it is an outgoing/invoice issued then it implies that sales were made on credit.

The incoming invoice will be used to record the information in the purchases journals/diary, while an outgoing invoice will be used to record information in sales journals/diaries

Credit note:

A document issued when goods are returned to the business by the customer or the business return goods to the supplier and to correct any overcharge that may have taken place.

If it is received, then it means part of the purchases has been returned and therefore the information will be used to record information in the purchases return journals, while if

issued then it means the part of sales has been returned by the customers and therefore used to record the information in the sales return journals/diaries.

Debit note:

A document used to correct an undercharge that may have taken place to inform the debtor to pay more. It therefore acts as an additional invoice.

Payment voucher:

A document used where it is not possible to get a receipt for the cash/cheque that has been received or issued.

The person being paid must sign on it to make it authentic.

It is therefore used to record information just as receipts Books of original entries/Journals/Diaries/day’s books/Subsidiary books.

These are books where the transactions are listed when they first occur, with their entries being made on a daily basis before they are posted to their respective ledger accounts.

The information in the source documents are used to make entries in these books.

The books of original entries include:

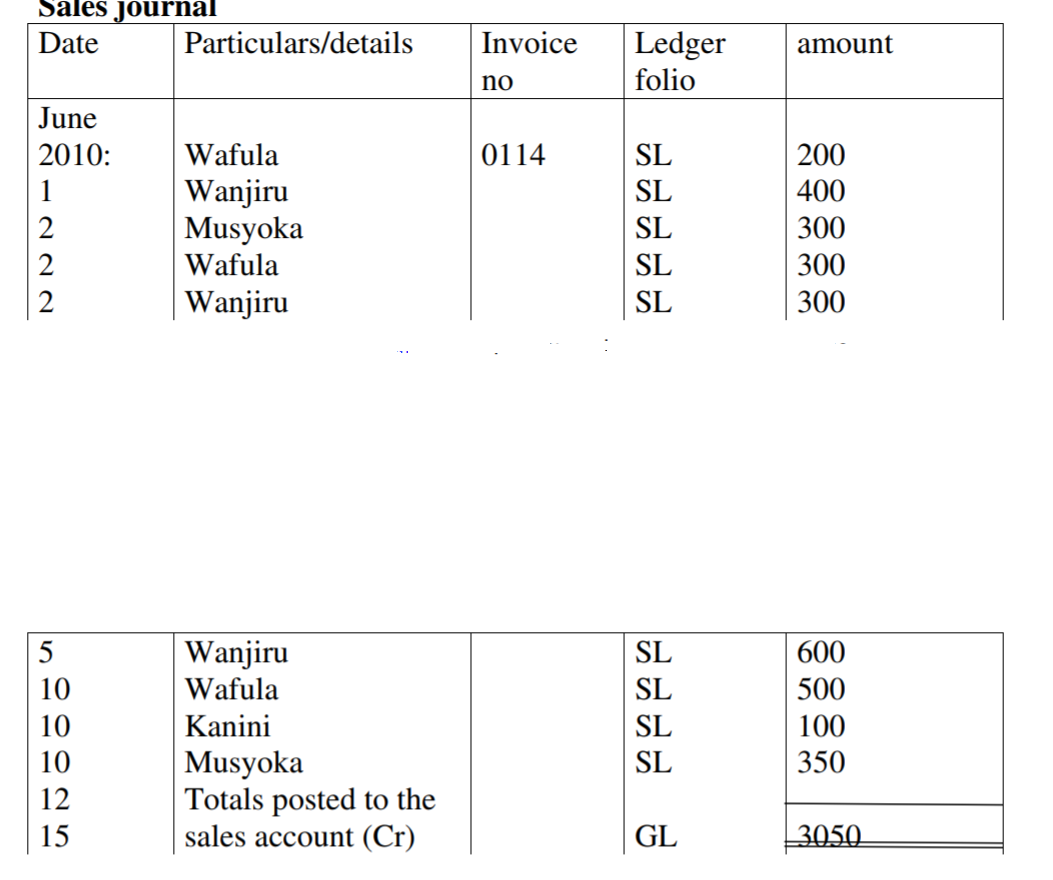

(i) Sales journals

This is used to record credit sales of goods before they can be recorded in their various ledgers.

The information obtained in the outgoing invoice/invoice issued is used to record the information in this journal as the source document.

The overall total in the sales journal is therefore posted in the sales account in

the general ledger on credit side and debtors account in the sales ledger as a debit entry.

Sales journal

Date Particulars/details Invoice

no

Ledger

folio

amount

Example:

The following information relates to Tirop traders for the month of June 2010

June 1: Sold goods to wafula on credit of ksh 200, invoice no 0114

2: Sold to the following debtors on credit; Wanjiru ksh 400,

Musyoka ksh 300, Wafula ksh 300

5: sold goods on credit to Wanjiru of ksh 300

10: Sold goods to the following on credit Kanini ksh 100, Wafula ksh 500, Wanjiru ksh 600

12: Sold goods on credit to musyoka of ksh 350

Required:

Prepare the relevant day book for the above transactions; hence post the various amounts to their respective individual accounts

Sales journal

(Post the rest to their individual debtors account)

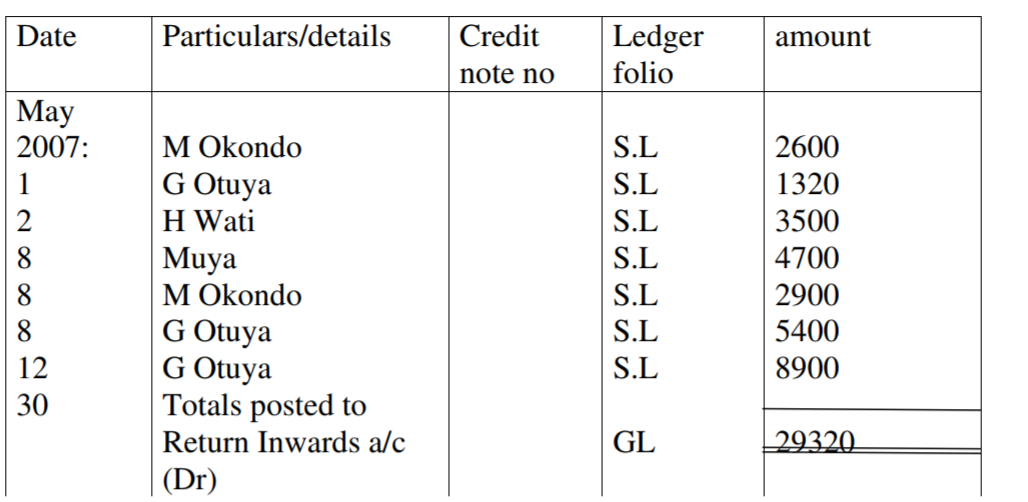

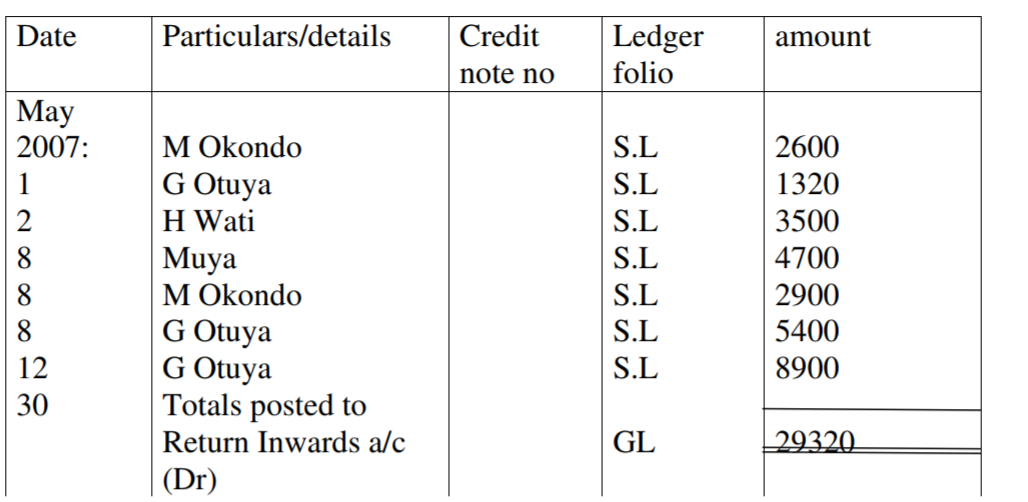

(ii) Sales Return Journals/Return inwards journals

This is for recording the goods that the customers/debtors have returned to the

business.

It uses the information in the credit note issued as a source document to prepare it.

The information is therefore recorded to the

(credited) also in their respective debtors account for double entry to be completed.

It takes the following format Sales return journal

Date Particulars/details Credit note

no

Ledger

folio

amount

For example;

Record the following transaction for the 2007 in their relevant diaries, hence post them to their respective ledger accounts;

May 1: goods that had been sold to M Okondo of shs 2600 on credit was returned to the business

“ 2: G. Otuya returned good worth shs 1320 that was sold to him on credit to the business

“ 8: the following returned goods that had been sent to them on credit to the business H Wati shs 3500, Muya shs 4700 M Okondo shs 2900

“ 12: G Otuya returned goods worth shs 5400 that were sold on credit to the business

“ 30: Goods worth sh 8900 that had been sold on credit to G Otuya were returned to the business

Sales Return journal

(Post the entries to the individual ledger a/c’s (Cr))

Purchases Journal

This is used to record the credit purchase of goods.

The totals are then debited in the purchases account in the general ledger, while the individual’s creditors accounts are credited.

It used the invoices received/incoming invoices as it source document.

It takes the following format;

Purchases journal

For example

The following information relates to Mikwa Traders for the month of April 2011. Record them in their relevant day’s book, hence post the entries to their relevant ledger accounts.

April 2011;

“ 2. Bought goods worth shs 25 000 on credit from Juma, Invoice no 3502

3. Bought goods worth shs 16 500 from kamau on credit, invoice no 2607

6. Bought goods worth shs 12 700 from Juma on credit, invoice no 3509

8. Purchased goods of shs 25 200 from juma, invoice no 3605; shs 17 500 from Kamau, invoice no 3700; shs 45 000 from Wamae wholesalers, invoice no 3750

15. Purchased goods of shs 9 200 from Wamae wholesalers on credit, invoice no 3762

18. Bought goods of shs 17 000 from Kamau on credit, invoice no 3802

24. Purchased goods of shs 36 000 from Juma suppliers on credit, Invoice no 3812

Purchases Day book

(Post the individual entries to their relevant accounts in the ledger (crediting))

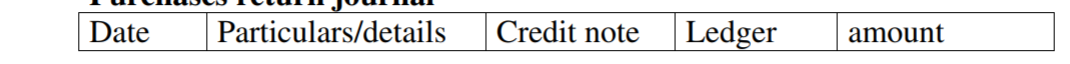

(iii) Purchases Return Journals/Return outwards Journals

This is used to record goods that have been returned to the creditors by the business, reducing the value of the goods that had been purchased.

It uses the credit note received as the source documents, with the totals being in the purchases return account while the individual creditor’s accounts are debite in their respective ledger accounts.

It takes the following format

Purchases return journal Date

For example:

Record the following transaction in the purchases return day book for Njiru’s

traders for the month of June 2010, hence post the information into their relevant ledger accounts.

June 2010;

“ 3. Returned goods worth shs 400 that had been bought from Nairobi stores, credit note no 56

“ 8. Return goods of shs 1 200 to Matayos store, Credit no 148

“19. Had some of their purchases returned to the following; Njoka enterprises shs 700, credit note no 205, Nairobi Stores shs 600, credit

note no 58, Matayos store shs 1 000 credit note no 191

“26. Returned goods worth shs 1 800 to Njoka enterprise credit note no 210

“30. Return goods worth shs 1 020 to Matayos store, credit note no 200

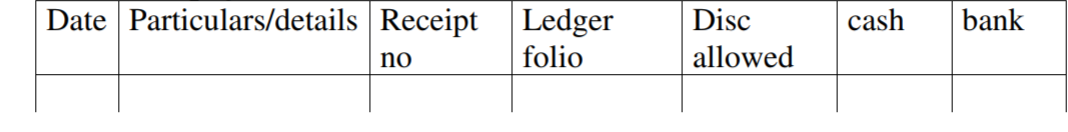

(iv) Cash receipt Diaries

This is used to record all the cash and cheques that have been received in the business.

They may be many that posting directly in the cash book may be tedious and are therefore first recorded here.

It totals are posted to the cash and bank accounts in the general ledger (Dr), while the individual accounts are credited in their respective accounts in the ledger.

It uses the cash receipt issued and bank slips received as the source documents.

It takes the following format;

Cash receipt journal

Source Documents and Books of Original Entry 1 | Source Documents and Books of Original Entry 2 |

Scholarship 2026/27

Current Scholarships 2026/2027 - Fully Funded

Full Undergraduate Scholarships 2026 - 2027

Fully Funded Masters Scholarships 2026 - 27

PhD Scholarships for International Students - Fully Funded!

Funding Opportunities for Journalists 2026/2027

Funding for Entrepreneurs 2026/2027

***