Financial Statements 3

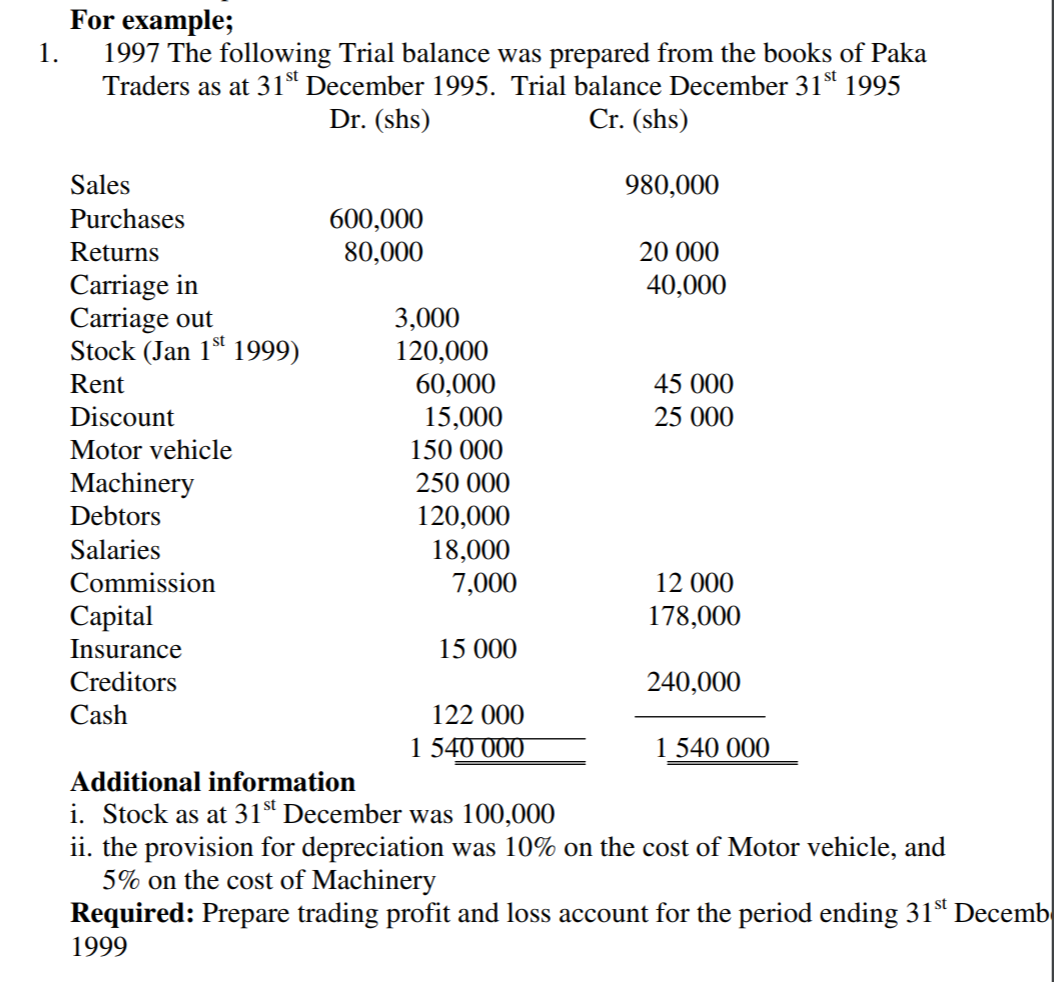

For example;

1. 1997 The following Trial balance was prepared from the books of Paka Traders as at 31st December 1995.

Trial balance December 31st 1995

Additional information

i. Stock as at 31st December was 100,000

ii. the provision for depreciation was 10% on the cost of Motor vehicle, and 5% on the cost of Machinery

Required: Prepare trading profit and loss account for the period ending 31st December 1999

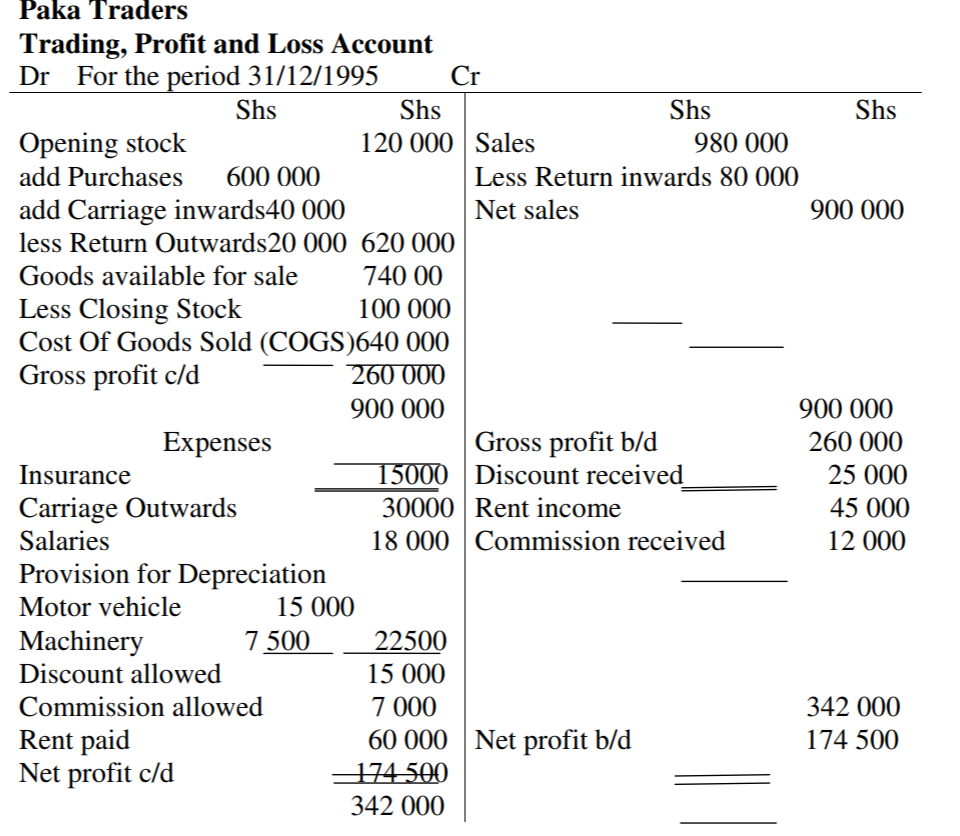

Adjustments: Provision for depreciation;

Machinery = 5/100(250 000)= 7 500

(New balance of machinery = 250 000 – 7 500 = 242 500.

The 242 500 is taken to the balance as Machinery (fixed asset), while 7 500 is taken to the trading profit and loss account as expenses)

Motor vehicle = 10/100( 150 000) = 15 000

(New balance of Motor Vehicle = 150 000 – 15 000 = 135 000.

The 135 000 is taken to the balance as Motor Vehicle (fixed asset), while 15 000 is taken to

the trading profit and loss account as expenses)

The net profit/loss may be taken to the balance sheet.

The items that have been adjusted will be recorded in the balance sheet less the adjustment.

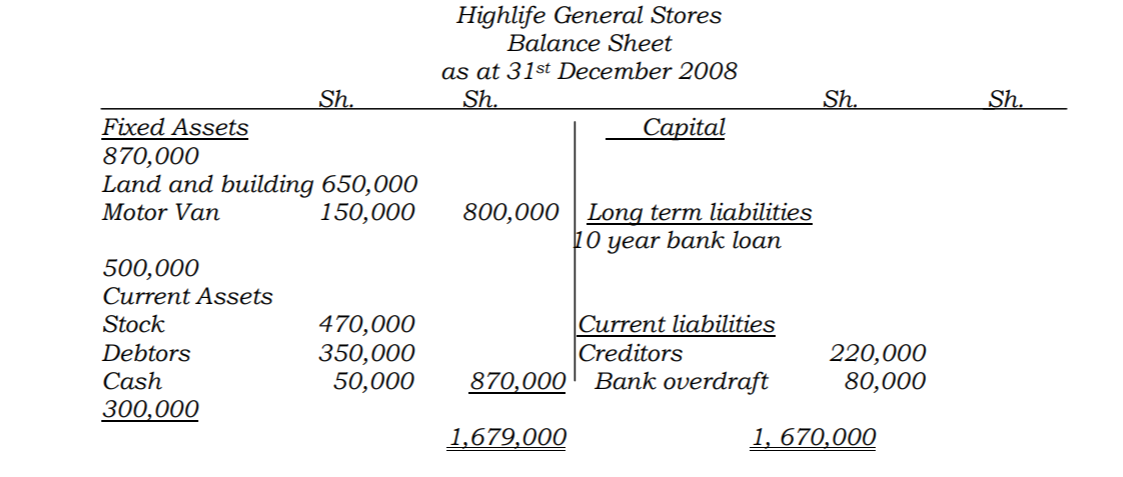

The Balance Sheet

The balance sheet will show the business financial position in relation to assets, capital and liabilities.

The adjustment that can be made will be on

Fixed assets and capital only.

That is;Fixed assets are recorded less their depreciation value (should there be provision for depreciation) as the actual value.

Actual value of assets = Old value -depreciation.

Capital is adjusted with the following; Net capital, Drawings and additional investment. i.e

Closing Capital/Net capital (C.C) = Opening/initial capital (O.C) + Additional

Investment (I) + Net profit (N.P) or (less Net Loss) – Drawings

CC = OC + I + NP – D

Where:

Opening Capital:

The capital at the beginning of the trading period Closing capital: - the capital as at the end of the trading period

Additional Investment: - any amount or asset that the owner adds to the business during the trading period

Net profit: - the profit obtained from the trading activities during the period.

In case of a loss, it is subtracted.

Types of Capital

The capital in the business can be classified as follows:

Capital Owned/Owner’s Equity/Capital invested;

This is the capital that the owner of the business has contributed to the business. It is the Net capital/Closing capital of the business (C = A – L)

Borrowed capital:

The resources brought into the business from the outside sources.

They are the long term liabilities of the business.

Working capital: These are resources in the business that can be used to meet the immediate obligation of the business.

It is the difference between the total current assets and total current liabilities.

Working Capital = Total Current Assets – Total Current Liabilities

Capital employed:

These are the resources that has been put in the business for a long term. i.e.

Capital Employed = Total Fixed assets + Working Capital Or

Capital employed = Capital Invested + Long term liabilities

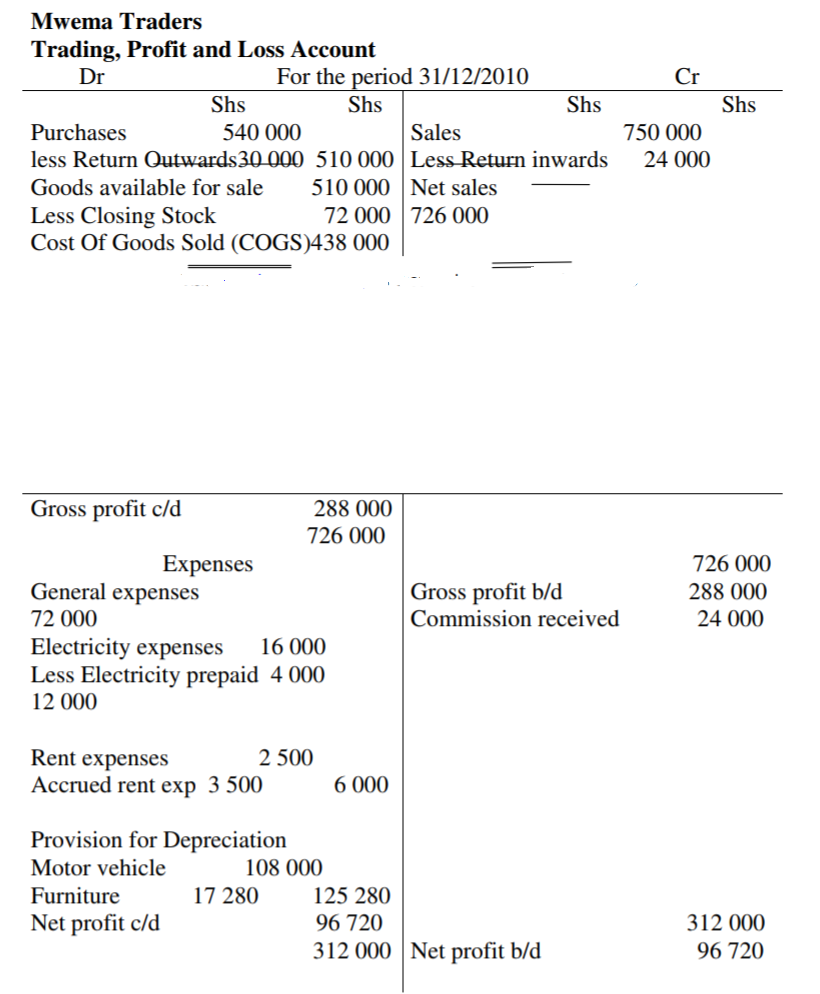

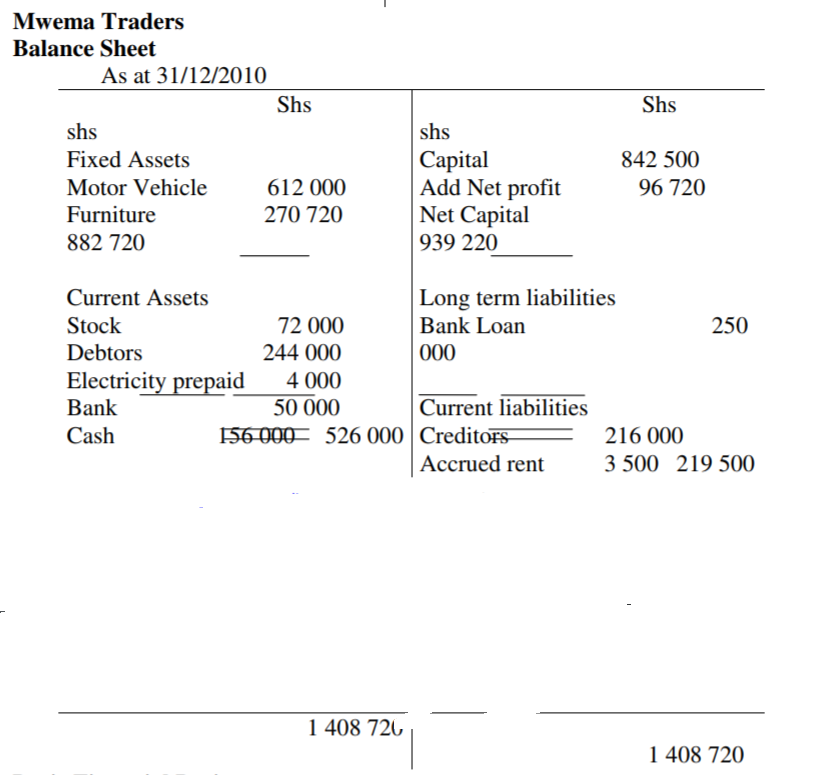

Example 00A: The following information were extracted from the trial balance of Mwema traders on 31st December 2010.

Sales 750 000

Furniture 288 000

Purchases 540 000

Electricity expenses 16 000

Sales return 24 000

Motor vehicle 720 000

Return outwards 30 000

Rent expenses 2 500

General expenses 72 000

Capital 842 500

Commission received 24 000

Bank Loan 250 000

Cash 156 000

Creditors 216 000

Debtors 244 000

Additional Information

a) Stock as at 31/12/2010 was ksh 72 000

b) Electricity prepaid was shs

c) Rent expenses accrued shs 3500

d) Depreciation was provided for as follows

-Motor Vehicle 15% p.a. on cost -Furniture 6% p.a. on cost

Required

(i) Prepare Trading, profit and loss account for the year

(ii) Prepare a balance sheet as at 31st December 2012

(iii) Determine the following:

-Owner’s equity -Borrowed capital -Working capital -Capital employed

Adjustments:

Motor Vehicle = 15/100 (720 000) = 108 000

Therefore Motor vehicle = 612 000

Furniture = 6/100 (288 000) = 17 280

Therefore furniture = 270 720

Basic Financial Ratios

A ratio is an expression of one item in relation to the other.

It is used to compare the groups of related items in the business, for the purpose of assessing the performance of the business.

They include:

a) Mark-up

This is the comparison of gross profit as a percentage of cost of goods sold.

i.e.

Mark-up = Gross Profit/Cost of goods sold(100)

For example: in (example OOA) above, determine the mark-up of the business.

For example: in (example OOA) above, determine the mark-up of the business.

Mark-up = GP/COGS(100)

Gross profit = 288 000

COGS = 438 000

Mark-up = GP/COGS(100)

Gross profit = 288 000

COGS = 438 000

288 000/438 000*100

= 65.75%

(This implies that the Gross profit of the business is 65.75% of its cost of goods sold)

b) Margin

This is the expression of the gross profit as a percentage of net sales. That is:

Margin =

For example: in (example OOA) above, determine the margin of the business

Margin = Gross Profit/Net Profit(100)

Gross profit = 288 000

Net sales = 726 000

=288 000/726 000*100

= 39.67%

(This implies that the gross profit of the business is 39.67% of the net sales)

Relationship between margin and mark-up

Since margin and mark-up are all the expression of Gross profit, it is possible to change one to the other.

Changing mark-up to margin

Mark-up can be changed to margin as follows:

(i) Convert the mark-up percentage as a fraction in its simplest form.

(ii) Add the value of the numerator of the fraction to the denominator to come up with the new fraction (margin fraction) that is If the

mark-up fraction = a/n

.

Margin fraction = a/n+a

(iii) Convert the margin fraction as a percentage to obtain margin For example: in the above example,

Mark –up = 65.75%

65.75/100

263/100

Margin fraction = 263/400+263

= 39.67%

Changing margin to mark-up

(i) Convert the margin percentage as a fraction in its simplest form

(ii) Subtract the value of the numerator of the fraction from the denominator to come up with the new fraction (mark-up fraction) that is.

(iii) Convert the mark-up fraction as a percentage to obtain mark-up

For example: in the above example,

If the margin fraction = a/n

Mark-up fraction = a/n-a

(iii) Convert the mark-up fraction as a percentage to obtain mark-up

For example: in the above example

Margin = 39.67%

= 39.67/100

=263/663

Mark-up fraction = 263/663-263

=263/400*100

= 65.75%

c) Current ratio/working capital ratio

This is the ratio of the current assets to current liabilities.

It can also be expressed as a percentage. That is:

Current ratio = current assets/current liabilities

= current assets: current liabilities

or Current ratio =current assets/current liabilities*100

For examples: in (example OOA) above, determine the current ratio;

Current assets = 526 000

Current liabilities = 219 500

Current ratio = current assets/current liabilities

=526 000/219 500 = 1052: 439

=526 000/219 500*100

=239.64%

Financial Statements 1 | Financial Statements 2 |

Financial Statements 3 | Financial Statements 4 |

Scholarship 2026/27

Current Scholarships 2026/2027 - Fully Funded

Full Undergraduate Scholarships 2026 - 2027

Fully Funded Masters Scholarships 2026 - 27

PhD Scholarships for International Students - Fully Funded!

Funding Opportunities for Journalists 2026/2027

Funding for Entrepreneurs 2026/2027

***